Using the 80/20 Pareto Law for Finances in a Budget Planner

Budgeting for the week ahead can be a challenging process. How can you pinpoint exactly what's costing you money? To manage your finances, do you really need to cut out all the fun purchases? When you're budgeting, using the 80/20 Pareto Law for finances in a budget planner can help you make the most out of your money.

What is the 80/20 Pareto Law (and How Can It Improve Your Finances)?

The 80/20 Pareto Law works on the principle that 80% of the benefits come from 20% of your actions. When you use the 80/20 Pareto Law for finances, this means that 80% of the most practical and enjoyable purchases you made came from only 20% of your entire purchases for that week/month.

Here's how the 80/20 Pareto Law can improve your finances in a budget planner - if you know that 20% of your purchases are the most effective ones, you can begin to cut down on the other 80%. For example, if you're an avid reader, you might treat yourself to a couple of books every week. But the cost soon adds up, especially if the books are purchased new. According to the 80/20 Pareto Law, you are most likely to truly enjoy just 20% of those books you bought. You can use the 80/20 Pareto Law to minimise your costs by borrowing 80% of your books from the library, and only buying the 20% that you know you'll re-read.

Where to Start Using the 80/20 Pareto Law for Finances in a Budget Planner

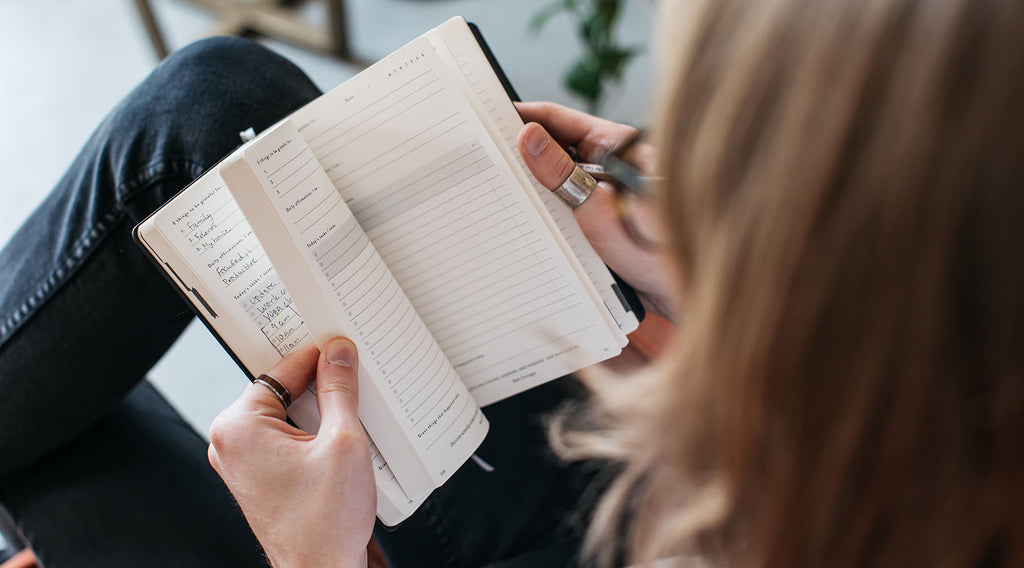

The first step for using the 80/20 Pareto Law for finances in a budget planner is to get a clear overview of your outgoing expenses. You can set this out in your budget planner, either as a chart or list. Group expenses into categories - e.g. bills, clothes shopping, dining out. Write down notes about the purchases in more detail. For example, with clothes shopping, how often do you wear the clothes you bought? Were they bought on impulse?

Using the 80/20 Pareto Law for finances in a budget planner can help you take control of your finances. If clothes shopping on impulse is an issue, use your budget planner to plot in particular dates for shopping. Write down details of exactly what you need to buy, and what you need it for. This can help you stick to the 20% of purchases that are actually effective for you, e.g. with clothes you have a need for and will wear, rather than the 80% that you impulse buy and only wear once.

How to Budget for the Week Ahead with the 80/20 Pareto Law

Using the 80/20 Pareto Law for finances in a budget planner can help you budget for the week ahead. You probably have weekly purchases that have become part of your routine. You can use your budget planner to adjust your weekly spending habits to make the most effective use of your money.

If you enjoy a take-out for 20% of your weekly evening meals, it's a special treat. If you have it every night, it becomes that mundane 80% that you don't enjoy so much. It's much more efficient to have healthy, inexpensive meals for the 80%, and then splurge for a takeaway treat on a Friday night. Do this for each of your expenses for the week. Keep in mind that 20% of your purchases will bring you the most happiness. Locate the purchases that make up the 20%, and cut down on the 80%, which are generally made of impulse or habitual purchases.

Ultimately, the 80/20 Pareto Law is a guideline, and in some cases, the 80% will include some great purchases. Using the 80/20 Pareto Law for finances in a budget planner isn't about cutting out every single unnecessary expense - sometimes a frivolous buy is exactly what brightens your day. The 80/20 Pareto Law is simply a technique to help you pinpoint what purchases matter to you, so you can get the most from your budget.